In the last 3.5 years, more than 46 000 auctions have taken place via the online auction service. In 66% of cases, multiple auctions were required to settle a single debt, and in half of the cases, debt repayment was not possible, based on the starting price. Banks, against individuals, are involved in speeding up the vast majority of foreclosures. Auctions soared in between 2020 lockdowns.

As of 12 June 2021, a total of 91 744 auctions had been posted on the online auction platform eauction.gr, following the country’s launch of the service in September 2017. The iMEdD Lab has looked into almost all auctions posted on the platform up to 31 May 2021. Of these, 51.2% have been completed, 41.8% are suspended and 1.2% have been canceled, while 5205 auctions (5.8%) have already been posted and are scheduled to take place by February 2022. For reference, according to publicly available data up to May 2021, more than 2100 posted auctions are scheduled for June 2021 and more than 1300 posts concern auctions scheduled for July 2021.

As of May 31, 2021, 46 198 online auctions had been completed, representing a total of 22 728 debt cases. That is, in 66% of cases, multiple auctions were required to settle a single debt. More than 3400 auctions are scheduled for June and July 2021.

Auctions in the country have been exclusively conducted online since 21 February 2018. Since auctions were suspended due to the pandemic, the primary residence protection did not cease in 2020 and was practically in effect. However, coercive measures of enforcement have been reintroduced and the protection of any type of property was abolished with the new Bankruptcy Code that enters into force as of 1 June 2021. Foreclosure auctions of vulnerable individuals’ primary residences carried out by banks and loan servicers are set to be suspended until the end of June 2021.

| Year | Auctions completed | Difference compared to previous year | Percentage change (%) compared to previous year |

|---|---|---|---|

| 2017 | 28 | ||

| 2018 | 17165 | 17137 | |

| 2019 | 18379 | 1214 | 7.1 |

| 2020 | 10613 | -7766 | -42.3 |

Auctions soared in between 2020 lockdowns

By 31 May 2021, a total of 46 198 online auctions had been completed, corresponding to 22 728 debt cases. That is, in 66% of cases, multiple auctions were required to settle a single debt, as the analysis of publicly available data suggests.

Auctions held in September and October 2020 were up 47% and 79% respectively, compared to the respective months of the previous year.

The majority of them (39.8%) were completed in 2019, suggesting a 7% increase compared to 2018, while auctions held in 2020 were down 42% compared to the previous year. Notably, however, September and October 2020 saw a 47% and a 79% increase in completed auctions respectively, compared to the same months of 2019. Considering that posted auctions on the platform decreased by approximately 3% in 2020 compared to 2019, it seems that the two months unaffected by the lockdowns and the summer of 2020 were marked by an auction frenzy.

Completed auctions over time

Bank involvement in 88% of auctions

As expected, banks are involved in speeding up the vast majority of foreclosures (87.5% out of 46 198 completed auctions). They are followed by natural persons (7.4%), other legal persons (4.4%), and various intermediaries aiming to speed up auctions (0.6%). Conversely, the majority of debtors whose assets have been auctioned off are natural persons (69.5%), while 30.5% of completed auctions involve legal persons.

Focusing on cases where banks, special purpose vehicles, and bank asset management companies jump in to speed up the auction process, 68.8% of auctions involve debts of natural persons –with the remaining 31.2% involving auctions of assets of legal persons.

Banks are involved in speeding up 88% of completed auctions – Against individuals in 69% of cases

Piraeus Bank, in particular, is estimated to be involved in the majority of auctions carried out by banks (33.7%), followed by Alpha Bank (24.1%), the National Bank (23.5%) and Eurobank (11.5%). These rates do not only emerge from auctions sped up by banks, but also companies that are linked to bank portfolios.

In other words, the rate of auctions attributed to each bank includes auctions that have been sped up by companies acquiring claims on bank loans and credits following a transfer (“special purpose vehicles”/foreign funds) or by domestic credit servicing firms representing banks. For example, it is estimated that Piraeus Bank is involved in more than 13 000 completed auctions (33.7% of those carried out by banks). However, by some accounts, 22% of these auctions were facilitated by a special purpose vehicle (represented by loan and credit management firms in Greece), to which the bank’s loans and credits had been transferred, rather than the bank itself.

Residential homes account for 32% of the property auctioned off to date

In a sample of 32 477 completed auctions involving any entity, for which the iMEdD Lab was able to identify the type of assets auctioned off by looking into the publicly available data, 97% of the cases are linked to real estate. In particular, it is estimated that 32% of the auctioned properties are residences, followed by plots with building (9.7%), land (9.3%), warehouses (8.6%), stores (8.3%), parking spaces (7.6%), plots without building (6%), etc. If we only take into account the properties of natural persons that were put under the hammer during auctions carried out by banks or companies representing them, the rate of residential properties rises to 38.3% of the auctioned properties.

Completed auctions by type of property

One in two debts not repaid, based on starting price

Based on a sample of 9 261 completed auctions, corresponding to 5 453 debt cases, 50% of debtors do not manage to pay off the total claim, considering the starting prices.

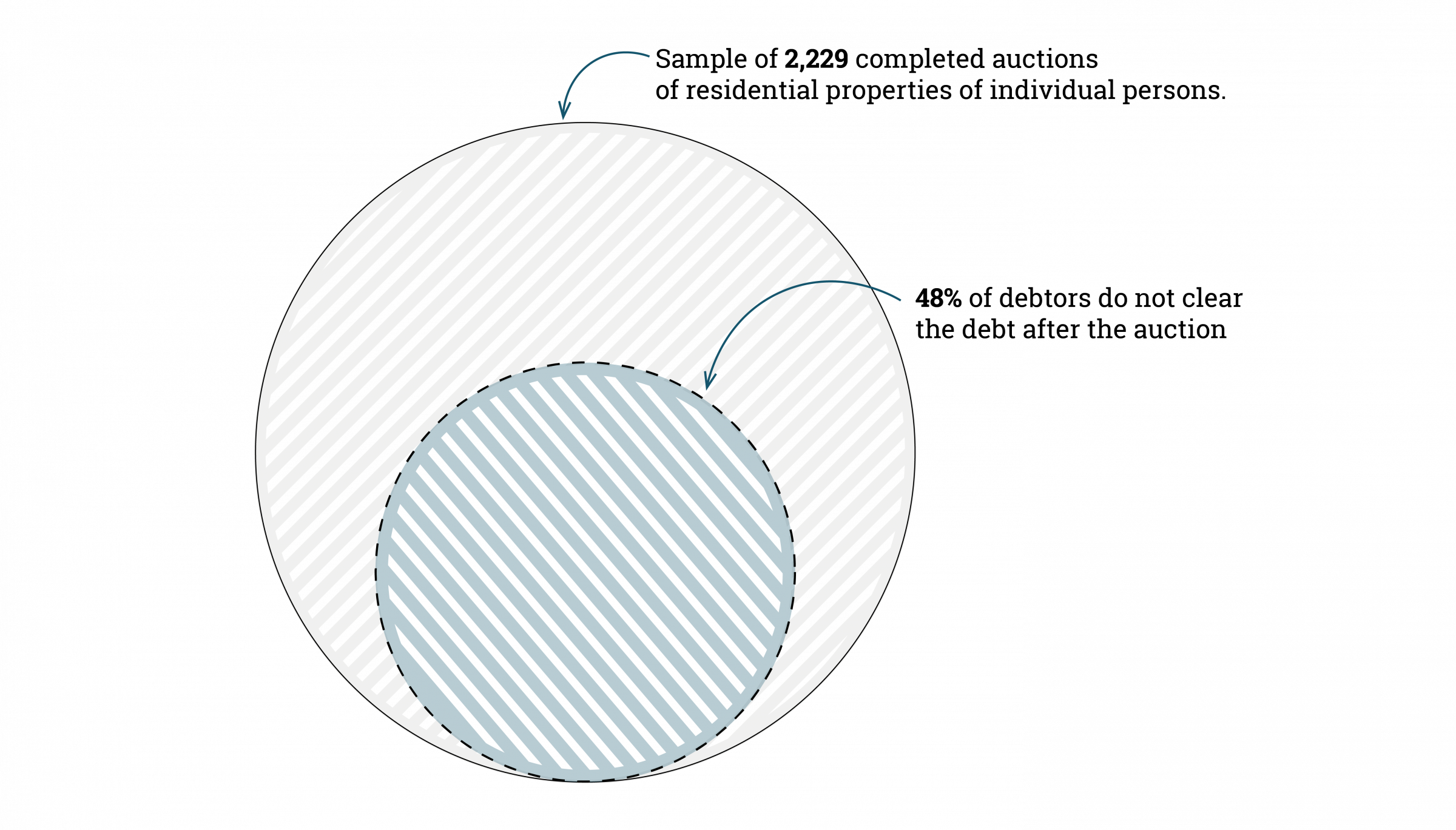

Nearly one in two debts are not cleared at the property auction, according to an iMEdD Lab data analysis. More specifically, by probing publicly available data, we were able to identify 9261 completed auctions, corresponding to 5453 debt cases (due to multiple auctions for the same debt case), for which both the total claim of the debt collector and the starting price for each auctioned asset of the debtor are known. The analysis of the data for this sample (5453 debt cases), with a median debt of €102 601, shows that 50% of debtors do not manage to pay off the total claim of the respective creditor by auctioning their assets –at least when taking into account the respective starting prices. Restricting this sample to debt cases linked to individuals whose residential properties were auctioned (2229 auctions corresponding to 1640 debt cases), it appears that 48% of the total claims cannot be repaid, considering the starting prices of these completed auctions.

Most of the houses foreclosed on belong to municipalities of the province, the northern and southern suburbs of Athens

Based on a sample of almost 10 400 auctioned residences, for which we were able to identify the geographical area, it appears that most of them are located in Attica (40%) and Central Macedonia (22.6%) –with the largest rates recorded in the municipalities of Athens (10.7%) and Thessaloniki (3.9%) respectively.

Map of auctioned homes by municipality

However, when taking into account the Hellenic Statistical Authority’s 2011 Population-Housing Census and upon calculating the ratio of houses auctioned to registered houses per municipality, we can observe that the areas which saw the majority of home foreclosures are municipalities of the province, as well as the northern and southern suburbs of Athens. More specifically, the municipalities of Thermi, Ermionida, Kassandra, Locroi, Pylaia-Chortiatis, Nafplio, Kifissia, Vari-Voula-Vouliagmeni, Filothei-Psychiko, Oraiokastro, and Distomo-Arachova-Antikyra make up the top ten.

To produce this story, iMEdD Lab collaborated with the non-profit organization Civic Information Office (CVCIO).

Translation: Anatoli Stavroulopoulou