Protecting the economy or the environment? Who will win the EV race? And why are French cognac producers worried? Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics and a vice chair of the National Committee on US-China Relations, speaks to iMEdD from Washington, DC.

In mid-May 2024, US President Joe Biden quadrupled tariffs on Chinese electric vehicles and tripled China tariffs on steel and aluminium products, marking another escalation in the ongoing trade war between Washington and Beijing. This move puts pressure on European car manufacturers and raises concerns about environmental protection.

The global electric vehicle (EV) market is currently one of the most dynamic sectors, and the trade harmony between the US and China is long gone. Once a one-way route for US exports to China, the flow has now reversed, with China flooding global markets with high-quality electric cars. To counter this, the Biden administration has imposed a heavy 100% tariff on Chinese EVs, aiming to protect domestic automakers.

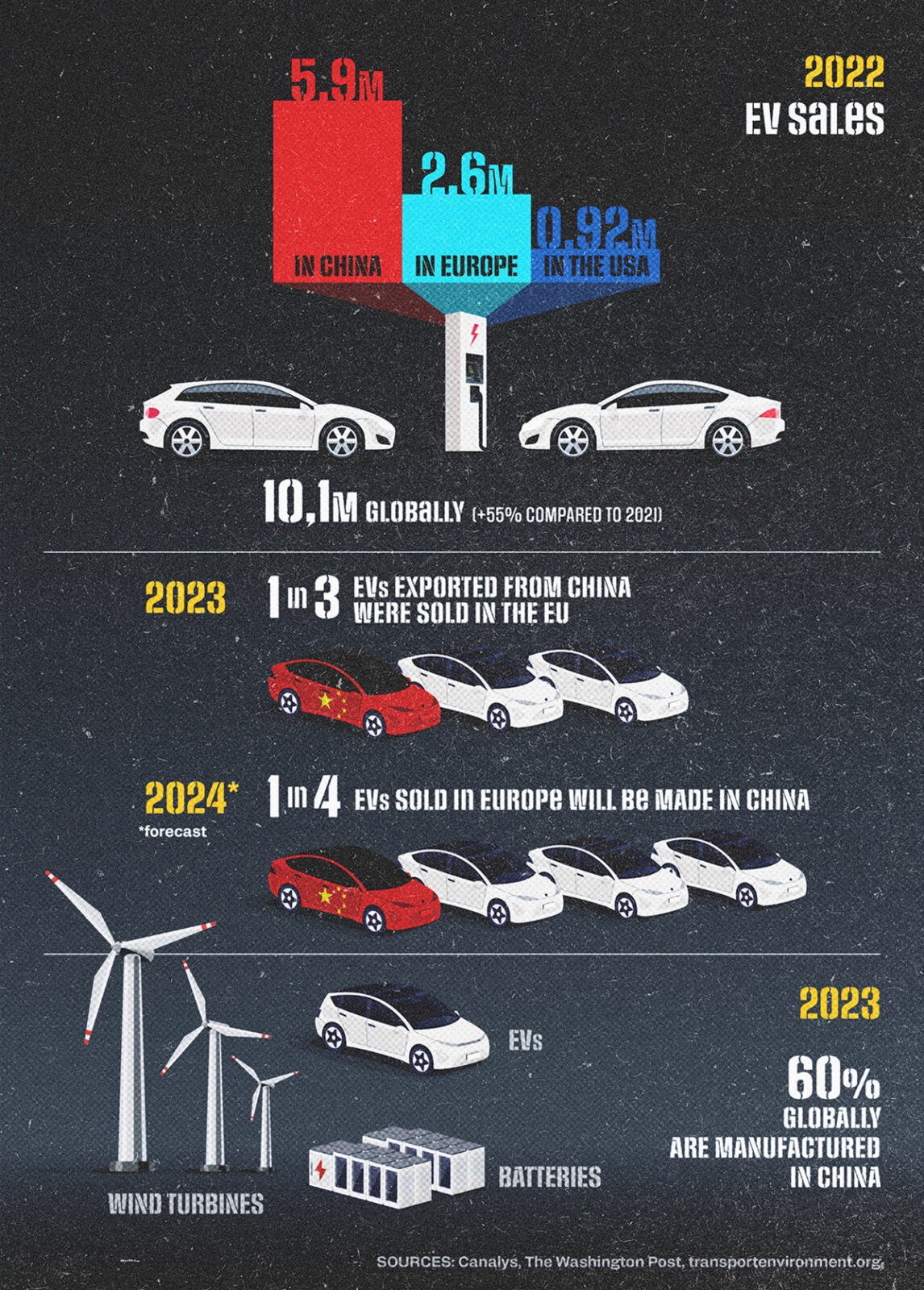

Canalys’ latest research shows that worldwide sales of EVs grew annually by 55% to 10.1 million units in 2022. Mainland China was by far the largest EV market, with 59% of EVs sold there in 2022, a total of 5.9 million units. Europe is the second largest EV market, with a 26% share and 2.6 million units sold. At the same time, the US is still behind at just 9% of worldwide sales, but with positive signs of growth, with 920,000 EVs sold in 2022, up 72%.

Last year, China exported more than 1.5 million electric cars to dozens of countries, with the EU being its biggest customer, importing almost half a million Chinese electric vehicles—accounting for one-third of Chinese exports. Experts say that one in four EVs sold in Europe this year will be made in China.

These numbers are a double-edged sword for the European Union. They provide significant leverage in the current geopolitical climate, but at the same time, they also make the EU vulnerable to escalating confrontation. A full-blown trade war could lead to a significant price increase for European consumers.

This situation could also affect the EU’s ambitious political agenda for the transition to a green economy, which relies heavily on the affordability of electric cars for European citizens. As Politico comments, Beijing has long been trying to prevent new tariffs with a “carrot and stick” approach: threatening retaliation on one hand, while promising growth and jobs by increasing production at Chinese automakers’ plants in Europe on the other.

US-China Trade War: Competing on the Economic Frontline with Dr. Konstantinos Tsimonis

We talked to Dr. Konstantinos Tsimonis, Senior Lecturer in Chinese Society at King’s College London and a member of the Institute of International Relations. We discussed the intricate dynamics of the U.S.-China trade conflict and whether we are witnessing a new Cold War.

Economy vs. Environment

America has taken decisive action in response to the dilemma between protecting the economy and the environment. Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics and vice chairman of the Board of Directors of the National Committee on U.S.-China Relations in Washington, D.C., doesn’t mince words on the claim that the US government is undermining the broader climate change agenda with its decision: “Yes, the Biden administration has clearly prioritised support for the US auto industry and other industries, even at the expense of achieving broader climate goals,” he tells iMEdD.

The inescapable fact, as the Washington Post wrote in its editorial, is that President Biden’s tariff wall makes the transition to a carbon-free future more costly and challenging, “with no guarantee the profits will be used for investments in cutting-edge green technology.” The White House is right about Beijing’s predatory trade tactics that have helped it create companies that lead the markets for critical green technologies.

“About 60% of the world’s wind turbines, electric vehicles, and batteries are manufactured in China. Beijing’s broader macro-economic policies tend to suppress domestic demand, thereby making exports the primary outlet for surplus production. This is prompting Europe to also contemplate protectionist measures,” the Washington Post wrote.

However, in addressing the climate crisis, Chinese industrial policy has achieved undeniable benefits. Beijing’s subsidised generation has slashed the cost of solar power by nearly 90% over the last decade. “What should not be overlooked is how this reduction has reshaped the electricity supply in the US and globally,” notes Michael Greenstone, former economist on President Barack Obama’s Council of Economic Advisers and now a professor at the University of Chicago.

Reducing vehicle pollution is crucial to achieving the current administration’s goal of cutting overall emissions to half of 2005 levels by 2030. However, meeting this goal could prove more challenging if American drivers cannot afford the highly economical electric cars manufactured by China’s BYD. BYD’s basic hatchback sells in China for about one-third the cost of the cheapest EV available in the United States. Just a few days ago, BYD announced the development of a new model capable of driving non-stop for more than 2,000 kilometres, which will enter production soon.

The effects of the trade war

“The effects of the trade war have been significant,” explains Nicholas Lardy, vice chair of the National Commission on US-China Relations, from Washington, DC. He provides context on its impact on the US economy and global trade over the past two years: “One key impact is the negative effect of tariffs on US manufacturing. Manufacturing in the US has been adversely affected by the tariffs, primarily because many companies depend on imported raw materials from China for their production processes, and these imports have become more expensive due to the tariffs,” he tells iMEdD.

“The US economy has also been affected as China retaliated with tariffs of its own, hindering sales of US products in the Chinese market. So these manufacturing companies are losing domestic sales in the United States, China, and third countries where their higher costs render them less competitive with alternative sources of supply,” Lardy adds.

Who will win this war?

The conflict between two major countries and economies could have far-reaching geopolitical consequences. This conflict between two major countries and economies could have far-reaching geopolitical consequences. What does Lardy think will be the main ones and how will Europe be affected? “Europe is in a difficult position, pressured by the US to align with its policy towards China, particularly in trade and technology. In fact, we are already witnessing reluctance among some major European companies, especially in Germany, to endorse the US-led anti-China alliance,” Nicholas Lardy explains to iMEdD.

Can it be said that the US and China are now in a full-blown economic and trade war? How much worse can the situation get? “The current disagreements fall short of a full-blown trade war. The primary concern for the US currently revolves around restrictions on the transfer of specific goods and critical technology to China, while trade in other commodities remains insignificant in volume,” explains Lardy.

Analysts note that one of the most significant achievements of the last half-century has been the remarkable reduction in global tariffs. As the Economist writes, “This reduction, from average levies on imports of more than 10% in the 1970s to 3% today, helped fuel a boom in international commerce and a near-tripling in global GDP per person. The more that countries opened up, the more they flourished.”

“Because trade largely benefits consumers but can harm certain workers and companies that oppose it, it always comes at a political cost. Today, that cost looms large in the minds of politicians. The consensus needed to support an open trading system is disintegrating, a process accelerated by China’s unfair practices and the protectionist moves in the US initiated under Trump,” Nicholas Lardy of the Peterson Institute for International Economics tells iMEdD.

So things are not looking optimistic. We asked him if, in this escalating trade conflict, one side might emerge victorious in the end. “If the war continues, I believe it will become evident that both sides will suffer losses. The exact magnitude of these losses is difficult to predict at this point, but they will certainly be substantial, impacting not just both sides but also the global economy,” he replied.

Europe and China

The European Commission has announced plans to implement additional tariffs, ranging up to 38.1%, on imported Chinese electric cars starting in July. This move risks retaliation from Beijing, which has threatened countermeasures to protect its interests. Brussels intends to combat perceived excessive Chinese subsidies by imposing additional tariffs ranging from 17.4% for BYD to 38.1% for SAIC, in addition to the standard 10% car tariff. According to Reuters calculations based on EU 2023 trade data, these tariffs could result in billions of euros in extra costs for carmakers at a time when they are grappling with declining demand and prices domestically.

Andrew Kenningham, chief economist for Europe at Capital Economics, sees the EU’s decision as a significant shift in its trade policy, given its frequent use of trade defenses against China but rare application to such a critical industry. European policymakers aim to prevent a recurrence of the solar panel situation from a decade ago, where the EU’s limited measures against Chinese imports led to the collapse of many European manufacturers. In October, the EU initiated an anti-subsidy investigation specifically targeting Chinese electric vehicles.

Electric cars and cognac

Germany quickly moved to address the situation. Transport Minister Volker Wissing claimed that “serious movement” is needed from Beijing regarding tariffs on imported electric vehicles and expressed hope that talks could prevent further escalation of the trade conflict. Chancellor Olaf Scholz’s government is advocating for what it calls an “amicable” solution. In April, Beijing enacted legislation aimed at boosting its capacity to retaliate in response to potential tariffs imposed by the US or EU on its exports. Already, Beijing has launched an anti-dumping investigation into imports primarily consisting of French-made brandy, leaving French cognac makers deeply concerned regarding potential retaliatory measures.

Read all articles and analyses of the Special Report: “US-China Trade War” here.